About

“A soliton is a wave that propagates with little loss of energy and retains its shape and speed after colliding with another such wave” (Merriam-webster.com)

Like the wave, our aim is to work with companies to create value together, even amidst various economic and non-economic uncertainties.

Methodology

Financial Analysis

Through financial analysis of companies, we examine the Income Statement (IS), Balance Sheet (BS), and Cash Flow Statement (CF) from multiple perspectives. This allows us to identify strengths and weaknesses, and assist in developing strategies for revenue improvement and growth.

We have conducted financial analysis for over 10,000 companies, including both small businesses and large multinational corporations, during my time at investment banks and other institutions. With extensive experience across various industries and company sizes, I provide precise and actionable advice based on this background.

AI&IT

We leverage AI and IT to propose operational efficiency improvements. By deeply understanding business operations through financial analysis, we specialize in recommending the development of simple, low-cost systems that focus on key points.

Additionally, we actively invest in and learn AI technologies, having earned two silver medals on Kaggle for a credit risk prediction model and a named entity recognition (NER) competition using language models. We incorporate the latest technologies into our approach to provide cutting-edge solutions.

Industries

Leveraging my investment experience across a wide range of industries—including manufacturing, real estate, food and beverage, healthcare (physicians and dentists), maritime, construction, wholesale and retail, telecommunications, and regulated power sectors—we are equipped to address the diverse needs of clients across various sectors.

What is common across all industries is that a detailed analysis of each transaction reveals challenges and strengths that transcend industry boundaries. Based on these analytical insights, I provide tailored recommendations to best meet the needs of our clients.

Case Studies

Operational Turnaround

Through financial analysis, we reviewed the cogs and focused on revenue improvement. Revising the cogs requires meticulous re-examination of each transaction, which is a painstaking process. However, once this process is established, it naturally fosters cost awareness and leads to long-term revenue improvement.

M&A Advisory

We have handled a variety of M&A transactions, including cross-border and domestic deals. We provide a comprehensive range of services, including negotiation, financial due diligence, and valuation. Additionally, we also conduct financial analysis and valuation for spin-offs of subsidiary companies.

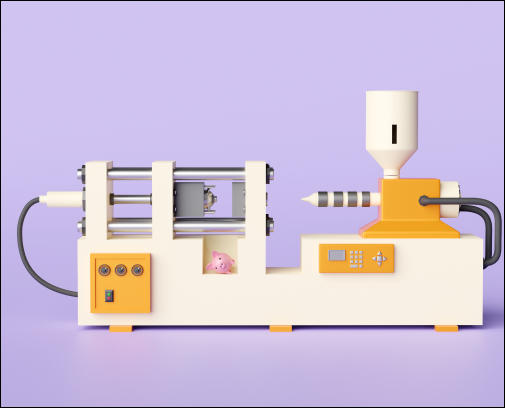

Consulting for SME’s

In a revenue maximization project for a manufacturing client, we reviewed their production system and optimized the processes. We developed a system capable of handling medium-volume production, transitioning from their previous mass-production model. By continuously refining these processes, we achieved improved accuracy in production planning and delivery.

Simple low cost system deployment

We deployed a simple, low-cost system to enhance efficiency in sales and procurement. The system allows for real-time monitoring and incorporates barcode-based inventory management and product inspection processes. Given the limited number of users, we proposed a small-scale, optimized system, replacing the previous paper and Excel-based management approach. This led to increased operational efficiency and cost reduction.

AM service for RE Investment companies

We provide asset management services to real estate investment companies. For clients focused on long-term investments, we ensure reliable maintenance and strive to maximize returns, ultimately enhancing property value.

Additionally, we have developed a property management system that standardizes information and facilitates prompt reporting.

Consulting for Venture firms

For venture firms, we provide a range of services, including:

- Business plan development support

- Management support services

- Fundraising advisory

Principal Investments

We are exploring investments in various projects using our own balance sheet. We have also successfully acquired several companies through M&A transactions.